The average asking price for a New Zealand house hit an all-time high with stock at an all-time low for May 2016, in a market which is heavily favouring sellers.

Real-time market statistics released by Realestate.co.nz show the May national average asking price reached $570,971, up 7.2 per cent from the same time the previous year.

On the supply side in May, the number of new properties that came onto the market nationally dropped 7.1 per cent from the previous month and the long term average has also fallen.

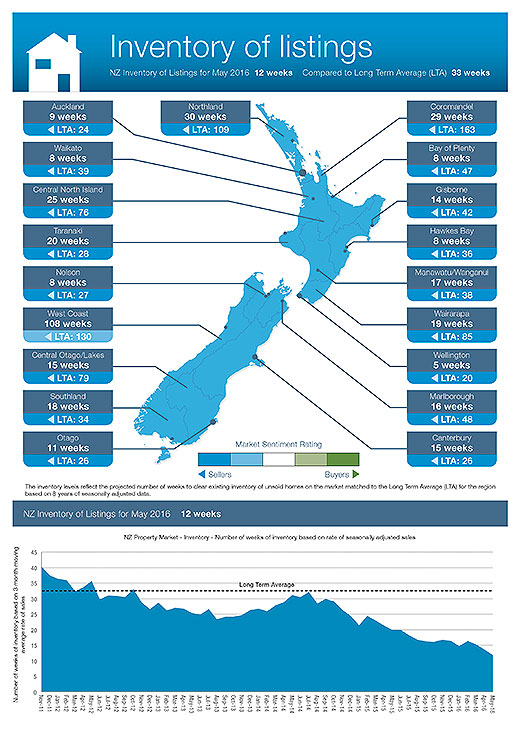

'In this environment, if no new listings were to come onto the market nationally and all the existing properties sold, theoretically there would be no properties for sale in New Zealand within 12 weeks,” says Realestate.co.nz spokesperson Vanessa Taylor.

'It's a classic supply and demand situation and right now it's definitely a sellers' market.”

Heightened real estate activity has been evident across both the North and South Islands.

The Central Otago/Lakes region and Nelson in the South Island are notable stand-outs, with Wellington, Waikato and Auckland in the North Island continuing to feature strongly.

North Island dominated by major cities

In April, Realestate.co.nz reported an all-time low in the number of properties for sale in Wellington.

In May, inventory levels dropped even further in the capital city. Theoretically, if no new listings were to be posted to the site and the existing properties sold, there would be no properties for sale in just 5.1 weeks (compared with 5.6 weeks in April 2016).

'Waikato also has an interesting profile,” says Vanessa Taylor.

'Asking prices are up a healthy 6.1 per cent on the previous month, coming closely behind Nelson and Central Otago/Lakes in terms of percentage increases across the country,” she says.

'At the same time new listings remain relatively static in the Waikato region.

'We could be tempted to make an assumption that Aucklanders are looking further south to the Waikato. However, data shows us that we have seen a strong (75.35 per cent) increase in users from the Bay of Plenty looking at the region. In saying that, the strongest interest is actually coming from users who already reside within the Waikato region,” says Vanessa.

'Drilling further down into the data, the hot spots in the Waikato region that are most searched are Cambridge, Te Awamutu and Morrinsville. Surprisingly, data suggests that Melville could be an up and comer with a 217.59 per cent per cent increase in online engagement.”

The average asking price in the Waikato is $467,717 compared to Auckland where it stands at $879,730.

Auckland is also suffering a fall in inventory levels, with listings down 9.2 per cent on the same time last year (May 2015).

'A fall of close to 10 per cent in listings in one year in a city the size of Auckland is very significant,” says Vanessa.

'At the same time Auckland asking prices have risen in the past month by 2.1 per cent (compared with April 2016) albeit off a high value base.”

Auckland asking house prices have risen 10.9 per cent compared to the same time last year (May 2015).

New Property Listings for May 2016, compared to May 2015 (all regions).

South Island regions on the up

In May, the Central Otago/Lakes topped New Zealand in terms of percentage average asking price at 17.2 per cent, the region also recorded the largest drop in new property listings down 32.9 per cent, both compared with the same time last year.

The average asking price for Central Otago/Lakes region for May hit $819,778.

Traffic data reveals a sharp increase in users residing in the neighbouring Otago region viewing property in Central Otago/Lakes, with engagement up by 75.98 per cent on the same time last year.

At the other end of the South Island, it's a similar story for Nelson, which recorded a record high asking price of $510,709 and a significant drop in new property listings (down 30.9 per cent on the same time the previous year).

0 comments

Leave a Comment

You must be logged in to make a comment.