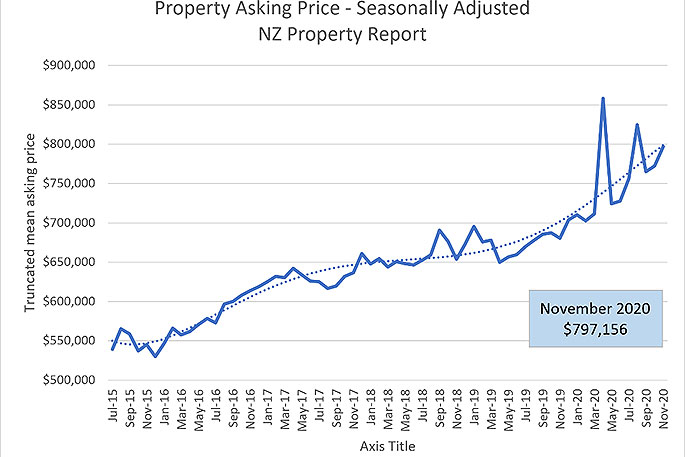

Real-time data from realestate.co.nz shows that low stock is continuing to drive increased property prices across the country, with seven regions reaching all-time asking price highs in November.

The national average asking price is $797,156 – a 17.1 per cent increase on November last year.

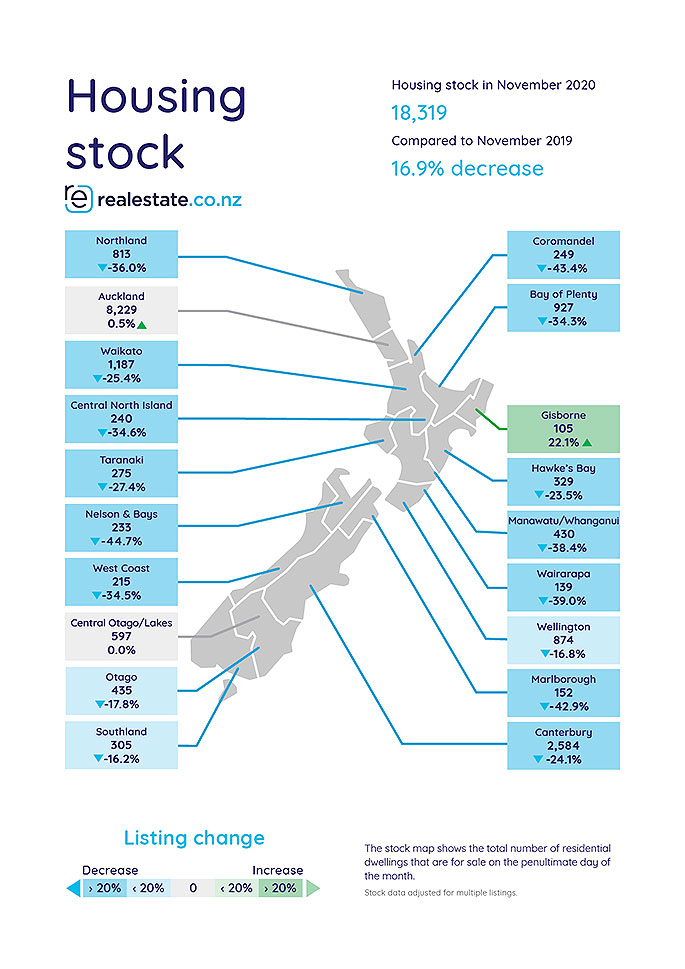

Vanessa Taylor, spokesperson for realestate.co.nz, says although 12,622 new listings came onto the market last month, overall stock levels remain low around New Zealand.

'Nationally the total number of homes available for sale in November was down 16.9 per cent on November 2019, with nine regions recording 13-year record stock lows. That's despite a 14.5 per cent year-on-year increase in new listings,” says Vanessa.

Although buyers will welcome the news that many regions saw an increase in properties coming onto the market last month, it may not be time to celebrate just yet.

Vanessa says demand remains strong with more than 1.33 million users recorded on realestate.co.nz in November 2020 - significantly more than the 1.08 million users searching during the same period in 2019.

'We know that Kiwis are still out looking for property and as long as demand keeps outweighing supply, we'll likely continue to see prices pushed upwards.”

Average asking prices continue to climb with 13-year record highs in seven regions.

Seven regions have hit all-time average asking price highs in November, according to the latest data from realestate.co.nz.

Auckland, Waikato, Hawke's Bay, Southland, Coromandel, Wairarapa and Manawatu/Whanganui all reached peak asking prices since realestate.co.nz records began 13-years ago.

Nationally, the average asking price for Kiwi properties is $797,156 – up 3.2 per cent on last month and up a significant 17.1 per cent on November 2019.

Vanessa says asking prices were up year-on-year in every region across the country, which is good news for those in the market to sell.

'While average asking prices indicate what vendors are expecting to get rather than what properties are actually selling for, they are usually a good indicator of what will happen with sales prices,” she says.

Auckland had one of the highest average asking prices last month, topping $1 million for the third consecutive month despite a significant 45.9% year-on-year increase in new listings.

In the Waikato, average asking prices reached an all-time high of $689,856. Lifestyle properties were a key driver in the market with a record $1,324,962 average asking price - up 27.8 per cent on November 2019.

'We saw close to 25,000 Aucklanders searching for property in the Waikato region on realestate.co.nz last month, and I expect that trend will continue as transport links continue to improve,” says Vanessa.

Lifestyle properties also reached 13-year highs in Manawatu/Whanganui where the average lifestyle asking price hit $814,344.

New listings up – but housing shortage remains with nine regions at record stock lows

Despite 12,622 new listings coming onto the market nationally last month, a 14.5 per cent year-on-year increase, the long-term stock shortage continues to prove challenging for Kiwi buyers.

Nine regions fell to 13-year total stock lows in November, with only 18,319 homes available for sale across New Zealand.

'Demand is still outstripping supply with the total number of homes on the market in November down 16.9 per cent on the same month in 2019,” says Vanessa.

All-time stock lows were recorded in Northland, Waikato, Bay of Plenty, Hawke's Bay, Nelson & Bays, West Coast, Coromandel, Marlborough, and Manawatu/Whanganui.

Nelson & Bays, Coromandel, and Marlborough had the lowest stock compared to 2019, decreasing by 44.7 per cent, 43.4 per cent and 42.9 per cent respectively.

Gisborne bucked the trend with a 22.1 per cent stock increase, while Auckland and Central Otago/Lakes maintained similar year-on-year stock levels to 2019.

'We can expect stock to remain low in December, when we typically see a drop off in new listings as the busy holiday season approaches,” says Vanessa.

'It will be interesting to see how things trend in the new year and I'm sure buyers will be hoping new listings continue to increase.”

0 comments

Leave a Comment

You must be logged in to make a comment.