Rent increases are picking up again, and property investors say official stats may be underestimating the extent of the increase.

In July, Stats NZ says, rent prices were up 4.1 per cent for both newly let and existing tenancies.

That is back to a level of annual increase not seen since September last year, and well above the 3.2 per cent of July two years ago.

Property investor Peter Lewis says the increases happening in the market were likely to be even higher than that.

Stats NZ says properties were included in the stock, or existing, tenancy measure for two years after a bond was lodged. If no other bond was lodged, it would drop out of the dataset.

Few landlords topped up a bond when rent increased, Lewis says.

“I regularly reset my rents as my many costs increase – as all NZ businesses do - but I have never taken a top-up of any bond, although this is legally permissible.

“Thus all my rent levels are, according to Government statistics, still at the levels of one, four or eight years ago. I am working on increases of around 7 per cent, but this in no way offsets larger percentage increases in council rates, insurance premiums and maintenance expenses let alone the frightening increase in my already sizeable tax bill.”

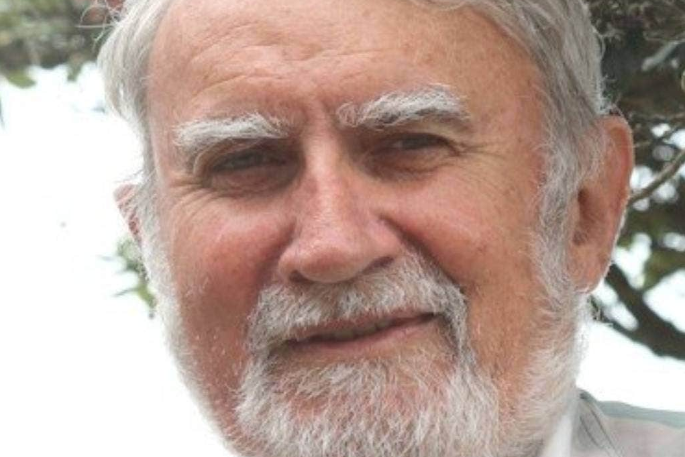

Auckland property investor Peter Lewis says the official data may not capture every increase. Photo: Supplied.

Auckland property investor Peter Lewis says the official data may not capture every increase. Photo: Supplied.

Stats NZ says, if a property dropped out of the stock data, it would be incorporated again the next time a bond was lodged.

“The coverage of the tenancy bond data is very high, including most rental properties in New Zealand.”

Lewis says a lot of investors were only now working out what the impact of the removal of tax deductibility of interest costs would be.

“Many have tried to ignore the reality of their situation, hoping it will just go away. However this current Government seems hell-bent on punishing residential landlords at any cost, even as the number of available rentals drops and their Housing NZ waiting lists increase.”

Another property investor, Graeme Fowler, says the last time he increased his rents, they lifted by 5 per cent.

“We always review the rents annually.”

That increase was roughly in line with inflation, he says, “We tend to be around 5 per cent below what the market rents are.”

Westpac chief economist Kelly Eckhold says the July increase was more than his team had expected.

Rising rental returns could pull more people into the housing market, he says.

Westpac expects house prices to rise 8 per cent next year.

“If we think forward to housing market trends next year, basically we don’t see a very big role for investors in that market for the foreseeable future due to the high level of interest rates and the constraints on the tax deductibility of interest. To the extent to which rents start to rise, that changes that equation a bit.”

He says, if National was to form the next Government and rolled back the tax deductibility change, that could have an impact on house prices.

ANZ senior economist Miles Workman says rents would be driven by household incomes, and supply and demand dynamics.

Landlords were not necessarily able to pass on the full extent of any increased costs such as interest, he says.

“if a landlord faces higher costs - regulation, rates, insurance, changes to tax settings, there will generally be limits around how much of that can be passed through to higher rents. That might sound like a good deal for renters, but this dynamic can also lead to fewer landlords willing to provide rental accommodation, meaning lower rental supply and potentially worse social outcomes overall.”

2 comments

Surely you know

Posted on 15-08-2023 19:27 | By Let's get real

Left wing governments want everything to be provided for them by the electorate out of the goodness of their hearts. Don't worry about earning a living and improving your life because that's going to be punished. We can't have any apparent differences between those that are willing to work and those that aren't. Vote left and get more rights to other people's money.

Fairness

Posted on 16-08-2023 06:58 | By olemanriver

Landlords are only needed temporarily in a properly functioning housing market. Allowing deductible mortgage interest for landlord and not home owners was never fair go. It was a shameful market distortion that has caused suffering and outrageous house prices. Mortgage interest should be deductible by both or neither on a level bidding field to be fair.

Leave a Comment

You must be logged in to make a comment.