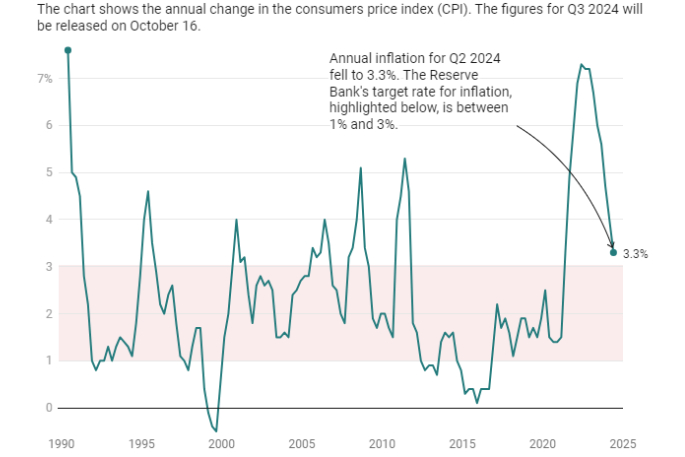

Annual inflation fell to 3.3 per cent in the June quarter, below Reserve Bank expectations of 3.6 per cent .

For the June quarter, inflation was just 0.4 per cent, according to figures from Stats NZ today.

The 3.3 per cent annual increase reported today followed a 4 per cent increase in the 12 months to the March 2024 quarter.

“The 3.3 per cent annual price increase is below what was seen during the peak in 2022, and is similar to three years ago,” Stats NZ consumers prices senior manager Nicola Growden says.

The Reserve Bank of New Zealand’s target range for consumer inflation is between 1 and 3 per cent.

Rental prices and rates were still a sticking point.

“Today’s inflation print came out below the RBNZ’s forecast, again.,” says KiwiBank senior economist Mary Jo Vergara.

It reinforced the downward momentum we were already seeing, she says.

“We’ve seen the headline rate fall from the 7s into the 6s, 5s, 4s, and now into the 3 per cent range. Forward-looking indicators point to further moderation in price growth. Business pricing intentions are weakening amid soft consumer and demand. And costs are easing as labour market capacity grows.”

Inflation was on track to fall below 3 per cent in the current (September) quarter.

“Today’s progress on core inflation has us growing in confidence that the RBNZ’s 2 per cent target will be achieved in 2025. The RBNZ should be in a position to deliver a rate cut by Christmas. We are sticking with the first cut to come in November, for now. But prospects for an even earlier cut are rising. It all depends on the data.”

Rent prices increased 4.8 per cent in the 12 months to the June 2024 quarter. And new house construction costs and council rates increased 3 per cent and 9.6 per cent respectively.

That made housing and household utilities the largest contributor to the annual inflation rate.

A big bump in insurance costs also drove inflation. Prices for insurance increased 14 per cent in the 12 months to the June 2024 quarter.

That was nearly double the rate back in June 2009, which was the previous highest peak in the series, Growden says.

Countering that was deflation in recreation and culture.

Accommodation deflation

Chart: NZ Herald

Chart: NZ Herald

Stats NZ recorded a 4.5 per cent decrease for accommodation services and a 3.4 per cent decrease for other recreational equipment and supplies prices, such as video games and pet-related products.

Non-tradeable inflation was 5.4 per cent in the 12 months to the June 2024 quarter (compared with 5.8 per cent in the 12 months to the March 2024 quarter), driven by prices for rent, insurance, cigarettes and tobacco.

Non-tradeable inflation measured final goods and services that did not face foreign competition and indicated domestic demand and supply conditions.

But foreign competition could influence the inputs of these goods and services.

Tradeable inflation was 0.3 per cent in the 12 months to the June 2024 quarter. That was well down from 1.6 per cent in the year to March 31.

Stats NZ recorded higher prices for petrol, accommodation services, and grocery food.

But lower prices for fruit and vegetables partly offset that, as did cheaper passenger transport services.

The data could provide some clues about the likelihood of interest rate cuts later this year.

Last week, the Reserve Bank shifted the tone of its language, expressing confidence inflation would move back inside its mandated 1-3 per cent range before the end of the year.

1 comment

Get ready

Posted on 17-07-2024 19:39 | By Saul

I predict a black Swan event in the coming months ahead.

Our financial system is coming to an end.

I know this will not get posted

Leave a Comment

You must be logged in to make a comment.