Spring has sprung, but green shoots of growth remain scarce across New Zealand Aotearoa’s housing market – for the time being.

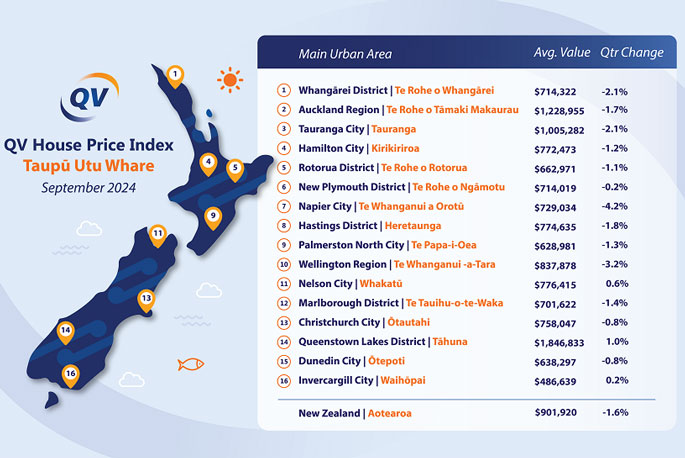

The latest QV House Price Index shows the average home decreased in value nationally by 0.4% last month and by 1.6% in the September quarter – compared to a 0.5% monthly decline and a 2% quarterly decline in our August index. The national average is now $901,920, which is just 0.3% higher than the same time last year.

The latest data also shows that home values have continued to slowly level out across much of the country in the September quarter, with the average three-month rolling rate of reduction slowing in Auckland (-1.7%), Christchurch (-0.8%), Hamilton (-1.2%), Dunedin (-0.8%) and most of the other main urban areas we monitor around the country.

In Tauranga, the average rate of home value decline has increased.

The city’s average home value reduced by 1% in the month of September – compared to a 0.4% reduction in August – with its three-month rolling rate of decline now sitting at 2.1%. This also compares to a 1.6% average decline nationally this quarter.

Tauranga’s average home value is now $1,005,282, which is still 0.3% higher than the same time last year.

"Interest rates have started to come down now, so we’re really starting to see sentiment shift across much of the country. There seems to be a spreading expectation that interest rates can only go one way, and so we’re seeing more people at open homes, in auction rooms, and browsing for property online," said QV operations manager James Wilson.

"And so it certainly seems like a general uplift in property values is now on the horizon, but despite growing confidence and optimism that we’re through the worst of it, the conditions aren’t yet conducive to growth. The cost of borrowing still remains relatively high, the cost of living is restrictive, and there are significant worries about job security – especially in Wellington."

Wilson said high levels of stock for sale on the market today were also having a dampening effect on prices.

"Generally speaking, those who are in a position to purchase still have a raft of different options to choose from right now, especially within the main centres. So there isn’t so much pressure on prices currently, with more than enough houses for sale to meet the current level of demand."

Image: QV

Image: QV

However, he expected that balance to slowly shift over the coming months – particularly if interest rates continue to fall.

"All eyes will be on the Reserve Bank’s October announcement. If the Official Cash Rate drops again, as many are expecting it to, it will reinforce the growing perception that now is a decent time to become reacquainted with the property market. A larger cut, like what we saw recently in the US, will only reinforce it even more.

"First-home buyers remain very much in the ascendancy right now, but we’re already starting to see more investors coming out of the woodwork. This will ramp up the level of competition in the housing market and help to absorb some of that excess stock. Values will inevitably tighten again when prospective buyers aren’t so spoilt for choice. That hasn’t happened yet."

0 comments

Leave a Comment

You must be logged in to make a comment.