For all of the property market’s many minor zigs and zags this year, the average home in New Zealand is now worth practically the same as at the start of 2024.

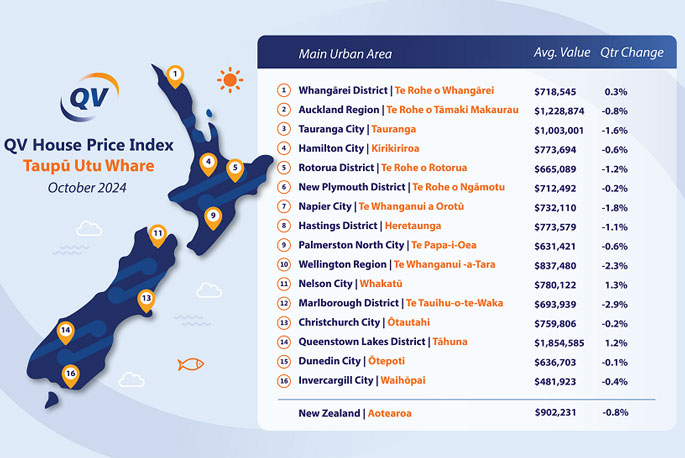

The latest QV House Price Index shows the average home value decreased nationally by an average of 0.8% throughout the three months to the end of October – compared to a 1.6% average decline in the three months to the end of September, and 2% in the three months to the end of August.

The average home is now worth $902,231, which is just 0.3% ($2,839) less than at the start of this year.

The value of an average home in Tauranga now hovers just above $1m, following five straight months of slow decline.

The QV House Price Index shows the city’s average home has reduced in value by 1.6% in the October quarter to $1,003,001 – an even slower rate of decline than the 2.1% and 1.5% reductions reported for the September and August quarters respectively.

On average, a home in Tauranga is now worth 3.2% less than at the start of this calendar year.

“New Zealand’s housing market remains largely flat overall, with essentially no growth to speak of during the month of October itself – neither up nor down – and only a slight decline nationally this quarter of less than 1% on average,” said QV operations manager James Wilson.

“Home values have flattened out again after some more sizeable yet still relatively modest reductions throughout the winter months, but they are still showing no signs of taking off anytime soon. This is reflective of a housing market that is still severely constricted by strong economic headwinds – despite recent interest rate reductions, which will still take some time to phase through.”

Likewise, our latest housing data also shows that home values have continued to slowly level out across most of New Zealand’s main urban areas, with the average three-month rolling rate of reduction slowing in Auckland (-0.8%), Christchurch (-0.2%), Hamilton (-0.6%), Tauranga (-1.6%), Dunedin (-0.1%) and more.

Even Wellington’s average rate of home value decline has slowed from 3.2% to 2.3% this quarter – though that figure is still more than twice the national average. “Heightened job insecurity is being more keenly felt in the capital. Otherwise, most of NZ’s other main centres appear to be bouncing along the bottom now.”

Just a trio of urban areas recorded positive growth this quarter – Nelson (1.3%), Queenstown (1.2%), and Whangarei (0.3%) – despite a marked increase in consumer confidence following recent mortgage rate cuts and a spreading expectation that the Reserve Bank will again cut the Official Cash Rate (OCR) later this month.

“There has been a notable mindset shift in recent times that we’re probably through the worst of it now, and that interest rates are going to continue to reduce. But this is being balanced out with a high level of stock available for purchase on the market, which is helping to keep prices down, as well as rising unemployment, which is still a very real concern for many,” Wilson said.

“Interest rate relief is on the way for homeowners, but it will take some time for it to be fully felt. In the meantime, active interest in the real estate market continues to grow. First-home buyers are still the most active buyer group today, but investors are slowly coming out of the woodwork again, as are owner-occupiers who have been waiting for conditions to improve.

“Housing affordability remains a challenge for everyone, even as economic conditions slowly improve. Prospective buyers have to weigh up the benefits of falling interest rates and having a smorgasbord of properties to choose from, versus rising unemployment and increased job insecurity. With that in mind, it’s little wonder why it’s still relatively quiet for this time of year and property values remain so weak.”

0 comments

Leave a Comment

You must be logged in to make a comment.