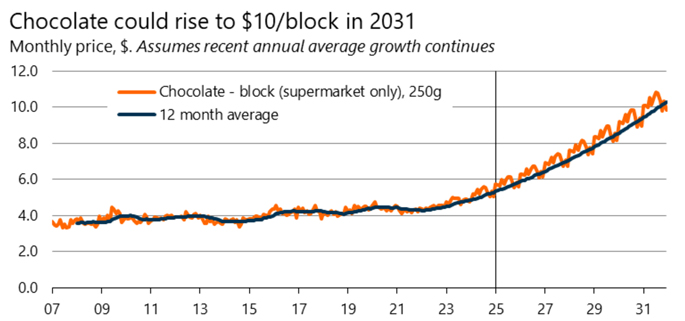

A 250g bar of chocolate could cost $10 in six years' time, if current pricing trends were to continue.

The average weighted price of a 250g chocolate block from the supermarket in January was about $5.72, up 17 percent from the year before, according to Stats NZ data.

The average chocolate bar price over the 12 months to January was also up 9.9 percent per annum.

Infometrics principal economist Brad Olsen said those price increases had been at a faster rate than usual.

But if they were to continue on that trajectory, he predicted a 250g block could reach $10 as soon as 2031.

Olsen said globally cocoa prices had been driven up by lower cocoa supply and prices were four times higher in 2025 than they were back at the start of 2020.

He said one of the big factors affecting food based products like cocoa was climate change - with both droughts and intense rain affecting crops and diminishing production.

In the past year alone the World Bank Commodity Price Index showed that cocoa prices were up 144 percent going from US$4.40/kg in January 2024 to US$10.75/kg in January 2025.

However, Olsen said the increases in retail chocolate prices had not been nearly as large as global cocoa spot prices over the past few years

"If chocolate prices here in New Zealand had tracked what global cocoa prices have done recently, New Zealand chocolate would already be costing $18 a block."

Olsen said the fact that domestic retail chocolate prices had not increased at the same pace as wholesale chocolate prices, likely indicated a few trends.

He said chocolate producers often had a supply contract that meant they paid a fixed price not the spot price, which could mean chocolate producers were not hit by increasing costs as quickly.

He said producers might also be reluctant to pass on the cost to consumers, as that could impact sales, market share, and customer satisfaction.

Photo: Supplied / Infometrics

Photo: Supplied / Infometrics

Whittaker's tries to keep prices stable

Whittaker's has over the past year been up front with consumers that it had to raise its prices on more than one occasion due to the ongoing cocoa shortage and rising costs.

The chocolate giant has also diversified its sources of cocoa supply to combat some of those challenges.

"While previously, Whittaker's had sourced only Ghanaian cocoa beans, from late 2024 we began sourcing cocoa beans from other parts of Africa that meet our stringent ethical standards. Our approach is to blend some of these with our Ghanaian cocoa beans to make our chocolate and maintain the same taste and quality Whittaker's is known for."

Those stringent standards include using only 100 percent Rainforest Alliance-certified and fully traceable cocoa beans.

"We're proud to make all of our chocolate right here in New Zealand and are focused on taking prudent steps like this to manage our supply chain so that we can keep prices as stable as possible for our Whittaker's Chocolate Lovers."

Consumers have got used to low prices

"We've been living in a bit of a illusion with regards to the price of chocolate and everyone's got used to it costing not nearly as much as it should," said Chocstock festival co-founder Luke Owen Smith.

He said the illusion was now shattering.

"The fact is chocolate should cost a lot more than it ever has," he said. "The the cheap price of chocolate that we've all got used to is based on a system that's very unfair for farmers and not very respectful of the environment, and all of those things are now kind of coming to a head."

With high demand but less available cocoa, Owen Smith said internationally there were already companies making 'fake chocolate', using ingredients like fava beans or sunflower seeds and adding in a chocolate flavour.

"Companies who have not put quality at the forefront in the past are very likely to sacrifice on quality more in the future," he said. "I think that that will create an even bigger divide between sort of cheap mass produced chocolate and higher quality smaller batch artisan chocolate, because those producers are a lot less likely to sacrifice quality."

*The data included in this article is based on if recent pricing trends continued into the future and is not a formal forecast.

0 comments

Leave a Comment

You must be logged in to make a comment.